You deserve to get paid for your efforts once you’ve completed a task/job/assignment/project or delivered a product. Small company owners may easily and quickly receive payment through mobile invoicing or online invoicing software.

Today, some firms continue to process payments and invoices using paper statements and invoices, spreadsheets, postage, and envelopes. Creating, printing, and delivering invoices may be time-consuming for any company owner. Well, that’s not the case now. Due to technological progress, billing and invoicing have experienced a fast transition, new applications, online billing software, and online payment gateways.

Top benefits to businesses for using mobile invoicing

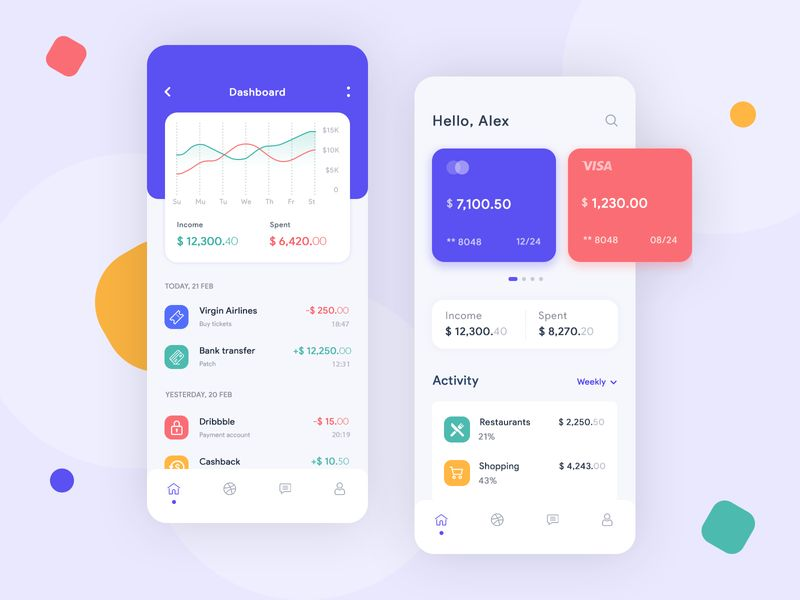

Mobile invoicing apps and online invoicing software streamline producing estimates, billing customers, paying suppliers, and monitoring payments or the latest project developments.

If you’re still unsure whether mobile invoicing and online invoicing software are important for your organization, the following explanations may help. So let’s go right to the point: the advantages!

-

You can manage the accounting data in a better manner

Cloud-based technology is a must for mobile invoicing and online invoicing software. It’s important to note that invoicing applications include built-in tools that sync incoming payment records with your company’s accounting software.

Any Invoice Generator App can be integrated with their mobile invoicing app. To exchange information with your suppliers, you may transfer data from the app to the program or the other way around. In addition, to save time, you may now replicate recurring invoices rather than starting again.

You have access to real-time visibility over all of your sales team’s transactions and statements, no matter where you are. This will make your company’s operations more efficient in the long term. In addition, automatic payments and invoices make it easy to manage prior records and enhance your cash flow.

-

It helps in doing transparent business across all the departments and clients

With mobile invoicing and online billing software, you can enhance your connection with your suppliers by streamlining payment procedures. In addition, customer happiness and security are enhanced by the ease with which invoicing applications enable quick and simple access to data.

Suppliers may quickly obtain payment data through online invoicing, which improves transparency. In addition, remittance information and notification of payment availability may assist create long-term connections with your suppliers.

-

It helps to achieve payments at a faster rate.

Payments are delayed if the billing process is delayed. Thanks to mobile invoicing and online billing software, invoices may be sent instantly, no matter where you are. Faster payments are made possible by an online invoice solution since the whole invoicing process is completed in real-time.

While the customer waits, receipts may be printed and signatures captured. So as soon as you get to work, start working on your invoicing right away.

Businesses are sending invoices as quickly as possible increases their chances of receiving money. In addition, clients save time and money by paying their invoices online instead of sending a paper check.

-

It will help in achieving a smooth, standard, and streamlined accounting process

Accepting mobile invoicing integrated with online invoicing software allows you to get your invoices straightforwardly. Interoperability is a key consideration in the design of mobile invoicing applications.

Using online invoicing software and cutting-edge technology, you can ensure that your billing process is consistent at every step. In addition, separate platforms for receivables and payables may make it easier to combine them into a single, more efficient process.

-

Without a doubt, it saves you a lot of money in the longer run.

The opportunity to reduce expenses is a big selling point for mobile invoicing. Traditional paper-based invoicing doesn’t need actual materials or a trip to the post office or bank to monitor your bills.

An online billing software, which can be downloaded for free and used while on the road, makes it easier to keep track of your expenses. Compared to desktops, smartphones are also more affordable and handier. With conventional paper bills, you may save money by not having to print and send them. In addition, by using mobile invoicing, your clients will be able to pay you more rapidly, improving your cash flow situation.

-

It allows you to work from anywhere and anytime

Suppose you have an internet connection and a smartphone or tablet. In that case, you may work from anywhere with the online invoicing software! So even whether your staff is at the gym, having a coffee, or out for a client-lunch meeting, they can still monitor and amend bills thanks to time logs and a cost tracker.

-

Reducing the volume of accounting work

Paper invoices are more prone to mistakes or errors than electronic invoices for recurrent bills. On the other hand, online invoicing software significantly decreases your accounting effort since it automatically inputs all of the necessary information and alerts you of any bills that are overdue or underpaid.

Wrap Up

We’re getting closer and closer to a digital-only economy every day. But, by not adopting new technology, you will be left behind by forward-thinking financial companies using the mobile invoicing to stay ahead of the curve. With mobile invoicing and online invoicing software, you can run your company while on the road.