Do you need a personal loan but don’t know where to start? If you’re like most people, you probably don’t even know what an ideal personal loan looks like.

Don’t worry, we’re here to help. In this blog post, we’ll show you how to get an ideal personal loan in minutes, without all the hassle.

First, let’s start with the basics. A personal loan is a loan that is taken out for personal reasons, as opposed to business reasons. This means that the loan can be used for a variety of things, such as consolidating debt, paying for a vacation, or anything else that you might need money for.

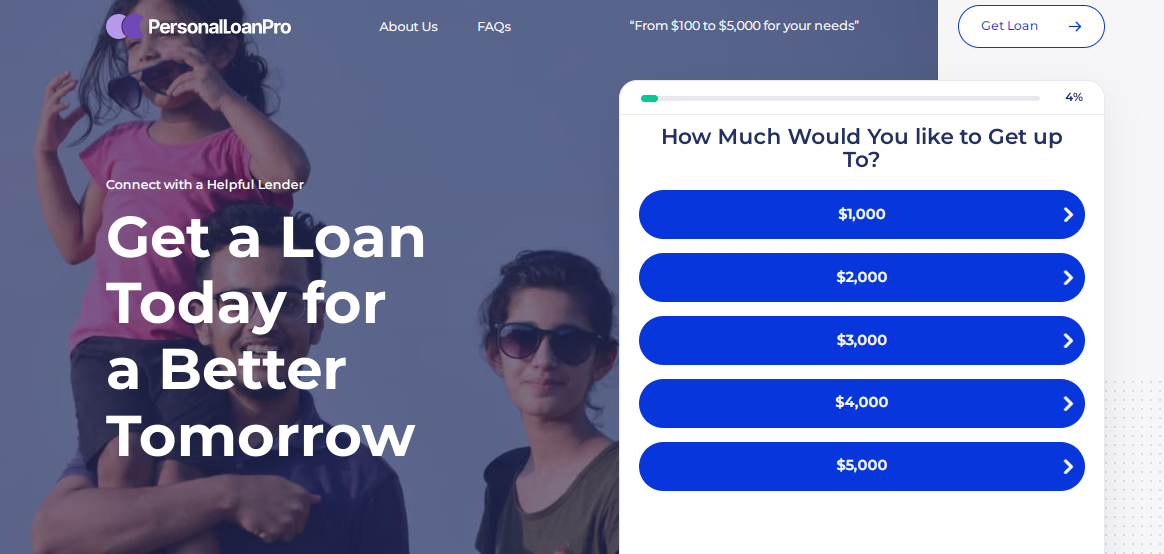

The next thing to consider is what kind of interest rate you’re comfortable with. Personal loan interest rates can vary, so it’s important to shop around. Online lending services like Personal Loan Pro help you to find the best rates. You might be surprised at how much you can save by simply taking the time to compare rates.

Once you’ve found a few personal loan options in the US that you’re happy with, it’s time to start the application process. This is where things can get a little tricky, as you’ll need to provide some personal information, such as your Social Security number and proof of income.

If you’re not comfortable with providing this information, you can always try to get a co-signer for your loan. This is someone who will agree to be responsible for the loan if you can’t make the payments. Keep in mind, though, that this will likely increase the interest rate on your loan.

Now that you know how to get an ideal personal loan, it’s time to start shopping around and see what’s available. Remember to compare interest rates and terms before you apply, and you should be able to get the loan you need in no time.

Why Do You Need A Personal Loan?

There are many reasons why you might need a personal loan. Perhaps you need to consolidate debt, finance a major purchase, or cover unexpected expenses. Whatever the reason, a personal loan can be a great way to get the money in the US you need.

But why do you need a personal loan? That’s a question you should ask yourself before you apply for one. After all, there are other ways to get money, such as using credit cards or borrowing from family and friends. So, why take out a loan?

There are a few key reasons why a personal loan can be a good option:

You’ll Get A Fixed Rate

Personal loans come with fixed interest rates, so you’ll know exactly how much you’ll need to pay each month. This can make budgeting and managing your debt easier.

You Can Get A Lower Rate

If you have good credit, you may be able to get a lower interest rate on a personal loan than you would with other types of loans. This can help you save money over the life of the loan. Click here to read more about how you can find lower rates.

You Can Borrow The Exact Amount You Need

With a personal loan, you can borrow exactly the amount you need. This can be helpful if you need to finance a specific purchase, such as a car or home repairs.

You’ll Have A Set Repayment Schedule

Personal loans come with a set repayment schedule, so you’ll know exactly when the loan will be paid off. This can make it easier to plan your finances and manage your debt.

A personal loan can be a great way to get the money you need. But before you apply, make sure you understand why you need the loan and whether it’s the best option for you.

Helpful Steps To Apply For A Personal Loan Quickly

Are you in need of a personal loan but don’t know where to start? Applying for a personal loan can seem like a daunting task, but it doesn’t have to be! With a few simple steps, you can quickly and easily apply for a personal loan that meets your needs.

First, you’ll need to gather some basic information about your finances. This includes your income, debts, and assets. You’ll use this information to calculate your debt-to-income ratio, which lenders will use to determine your loan eligibility.

Next, you’ll need to choose a loan type and lender. There are a variety of personal loans available, so it’s important to compare rates and terms to find the best deal. You can find a lender with Personal Loan Pro then you can begin the application process.

Most lenders will require you to submit some basic information about yourself and your finances. They may also run a credit check to determine your loan eligibility. If you’re approved, you’ll be able to finalize your loan and receive the funds you need.

With these helpful steps, you can easily apply for a personal loan in the US and get the funds you need.

Can I Get A Personal Loan If My Credit Is Bad?

It’s a common question – can I get a personal loan if my credit is bad? The short answer is, unfortunately, no. Personal loans are typically only offered to those with good or excellent credit. That’s because lenders see bad credit as a sign that you’re more likely to default on your loan.

So if your credit is bad, you’re likely to be denied a personal loan. However, that doesn’t mean you’re out of options. Try a loan broker like Personal Loan Pro for better guidance. There are a few things you can do to try to improve your chances of getting approved:

1. Check Your Credit Report And Score

There may be errors on your report that are dragging down your score. If you can identify and correct these errors, you may see your score improve.

2. Try A Different Type Of Loan

If you’re denied a personal loan, you may have better luck with a secured loan. With a secured loan, you’ll put up collateral (such as a car or home) to guarantee the loan. This reduces the risk for the lender, making it more likely that you’ll be approved.

3. Find A Co-Signer

If you can find someone with good credit to cosign your loan, you may be able to get approved. The cosigner will be responsible for repaying the loan if you default, so it’s important to choose someone you trust.

4. Wait And Rebuild Your Credit

If you’re not in a hurry for a loan, you may want to wait a few months to a year to improve your credit. You can do this by making all your payments on time, keeping your credit balances low, and using a mix of different types of credit.

Ultimately, whether or not you can get a personal loan with bad credit depends on the lender. So it’s important to shop around and compare offers before you apply. And if you’re denied, don’t give up! There are other options available to you.