The White House Extends Student Loan Pause

Apparently the white house has decided to extend the student loan pause. This means that for the next few years student loans can be paused until they are paid off. There are also questions about how long the pause will last.

White house extends student loan pause – Student Loan

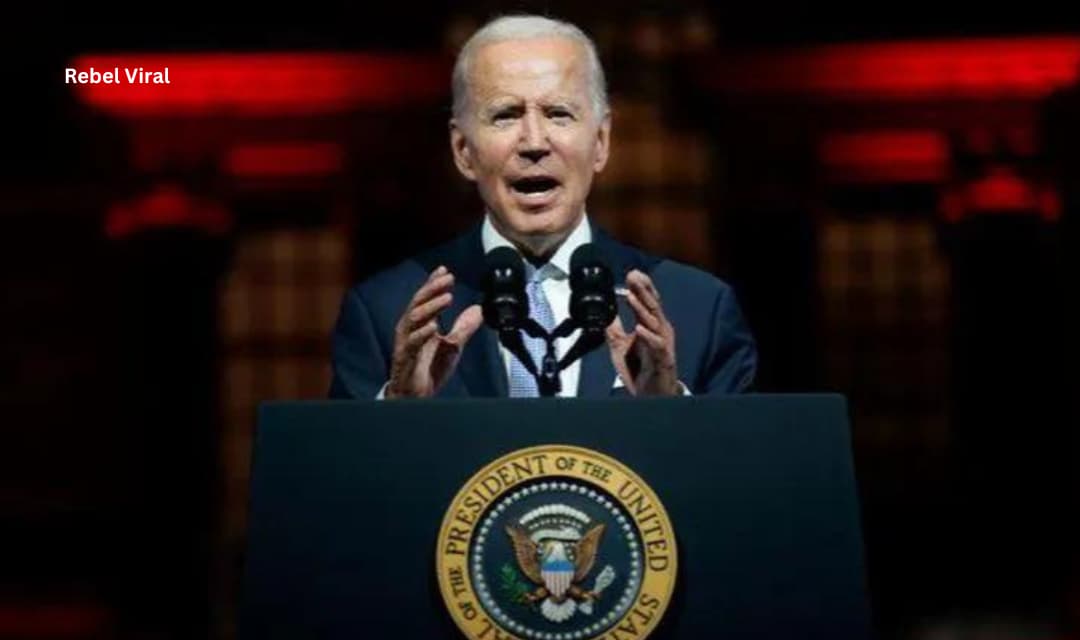

Several months after a federal court blocked President Joe Biden’s plan to cancel student debt for tens of millions of Americans, the White House is extending a moratorium on federal student loan payments. This will give the Supreme Court a chance to decide on the program.

The Biden administration rolled out its one-time cancelation plan in August, hoping to ease the transition for struggling borrowers while litigation rages. The program would cancel up to $20,000 in student debt for eligible borrowers. But it has since been blocked by both legal challenges and conservative groups.

Which one Best! Short-Term Car Loans VS Long-Term Auto Loans

A Department of Education official told reporters that the department was trying to assess the economic impact of a moratorium. They said that, based on estimates, a continuing pause would cost the government several billion dollars in lost revenue each month. But they also warned against restarting loan payments until the court challenge was settled.

The Education Department said it would postpone restarting monthly student loan payments until at least 60 days after a settlement is reached. That will allow borrowers to receive a “fresh start” and give the Department of Education time to assess the performance of the program.

Joe Biden Student Loan Pause

Despite a federal appeals court ruling last week, President Joe Biden’s long-awaited student debt cancellation plan is still stuck in court. A federal judge in Texas found that the plan was unconstitutional, and Republican state attorneys general filed a lawsuit against it.

Read More! Why Is Checking Your EMI Through a Personal Loan Calculator Important?

The White House has taken up the case and will seek to extend the pause on student loan repayments. The decision could help struggling borrowers during the holiday season. But, it will also add to the nation’s ballooning national debt.

In its statement, the Department of Education said that payments would not begin again until 60 days after the litigation is resolved. In addition, the education department said that borrowers would have 60 days before interest begins to accrue on their loans.

A Department of Education official said that a new income-driven repayment plan would also be released. In addition to the new repayment plan, the department will update regulations to improve the Total and Permanent Disability Discharge program. The Department of Education also indicated that an extension of the payment pause may continue until June 30, 2023.

Student Loan Pause Extension

Despite a ruling last week by a federal appeals court that blocked President Joe Biden’s one-time student debt cancellation plan, the White House has extended a moratorium on federal student loan payments until June 30. The decision comes as the federal government continues to fight legal challenges to the plan.

Biden’s plan to cancel tens of millions of student debts will remain in limbo until the Supreme Court rules on the matter. The White House said last week that the administration would ask the court to reinstate the plan.

A senior administration official said the decision was an effort to protect the program from legal challenges. However, many stakeholders are skeptical about the plan’s continued implementation after two years.

The Department of Education said it would provide targeted debt relief to borrowers, including up to $10,000 for Pell Grant recipients and up to $20,000 for non-Pell Grant recipients. The department indicated that the extension may continue until June 30, 2023.

The Education Department said it will postpone monthly student loan payments until 60 days after the debt relief program is implemented. A spokesman said interest will begin to accrue on loans after that.

Student Loan Debt Pause

Despite a federal court ruling last week, the Biden administration has extended a student loan debt pause until at least June 30, giving the Supreme Court more time to rule on the program. President Biden has said the extension is necessary because of legal challenges brought by special interests.

Hidden Facts! Different Styles of Pants and Trousers

The plan is designed to cancel up to $20,000 in debt for eligible borrowers. Borrowers can apply for debt cancellation in one of two ways. They can receive a grant of up to $10,000 to cover the costs of their loans or receive the full amount of their debt cancelled.

The plan was designed to help borrowers struggling during the holidays. It’s also designed to help borrowers who make less than $250,000 a year.

The pause is the eighth time the Education Department has extended a student debt relief policy. The change is time-limited and applies only to loans taken during non-consecutive service.

It’s also the first time since the start of the Covid pandemic that payments have been paused. The pause, which is designed to provide borrowers with financial security before the holidays, was scheduled to expire in December.

Student Loan Payment Pause

During the last week, President Joe Biden announced that he would extend the student loan payment pause until June 30. This will provide relief to millions of borrowers. During this time, the Education Department will provide targeted debt relief to struggling borrowers. The administration will also provide up to $10,000 in debt cancellation for non-Pell Grant recipients.

Must Read: www lowes com – Lowes Founded & Lowes Online Shopping

President Joe Biden said in a statement that the extension would allow the Supreme Court to review lower court orders that blocked the administration’s student debt relief plan. The White House has been fighting a legal battle to save the plan.

The pause is part of a bill that Congress passed in 2020, called the CARES Act. It provides debt relief to borrowers with federal loans, including loans taken out before 2009. In addition, the pause will allow borrowers to avoid making payments for two months.

As the pandemic hit, the administration took action to prevent interest from accruing on student loans. It set the interest rates to zero. This was a move that economists said helped the economy.

Private Student Loan Pause

Several months after the White House extended its private student loan pause, the Biden administration decided to take the next step. This time, it pushed the deadline back by 90 days, from the end of January to May.

Hidden Facts: www xfinity com – Xfinity Monthly Service Charge & Mobile App

The extension comes after President Biden’s plan to cancel millions of student loans proved to be unconstitutional in a federal court earlier this month. It also comes on the heels of a federal appeals court ruling that temporarily blocked the program from distributing funds.

The new plan includes a variety of benefits for borrowers. It includes a “fresh start” for all borrowers, as well as targeted debt relief for those who are already in default. But the plan also adds $400 billion to the national deficit over the next 30 years, according to a nonpartisan Congressional Budget Office study.

The plan also includes debt cancellation for borrowers who receive Pell Grants, as well as other federal student loans. For non-Pell Grant recipients, the Department of Education will also provide up to $10,000 in debt cancellation.

Will student loans be paused again in 2023?

Whether or not student loans will be paused again in 2023 is still up in the air. In August, President Joe Biden announced a sweeping plan to cancel student loans, but multiple lawsuits have stalled the program.

Let Me Show: www chase com – Chase Credit Card Scam Email & JP Morgan Chase Emails

Biden’s plan would forgive up to $20,000 in federal student loans per eligible borrower. He had planned to begin the plan by January 2023. However, legal challenges have delayed its implementation by at least two months.

Six plaintiffs filed lawsuits against the Biden administration. They argued that the Education Department illegally violated the Administrative Procedure Act by not allowing public comment before implementing the student loan forgiveness program. A federal appeals court in Texas blocked Biden’s plan. A federal judge in Texas has also ordered the Department to halt the program.

The Department of Education has filed an appeal to the U.S. Supreme Court to overturn the lower court rulings. It has also asked the court to lift the lower court’s order blocking the student loan forgiveness program.

If the court agrees with the Department of Education, the pause on loan payments will be extended again. This will give the Supreme Court time to rule on the program. If the court doesn’t rule before June 30, payments will resume sixty days after the lawsuits are resolved.

How much longer are student loans paused for?

Currently, the government has frozen student loan payments. This pause has been in effect since March 2020. There are still almost 40 million Americans who have not been required to make payments since then.

Before Loan: Is Short-Term Loans Suitable For Your Business?

The question of how long is the student loan pause for is not easy to answer. There are numerous factors that could influence the decision to extend the pause. One of the main reasons is the rising interest rates. Another factor is the recent court rulings against the Biden administration.

A survey by Savi found that almost nine in ten borrowers were concerned about inflation when they were expected to resume payments. Another reason the government should extend the student loan pause is because of the HEROES Act of 2003, which allows the government to modify student loan programs in response to national emergencies.

One of the ways the government could extend the pause is by reducing the size of payments under an income driven repayment plan. This could be good news for some borrowers. But this would require the Department of Education to implement a new rule.